Indian Banking: Building Resilience For the Future

Indian banks have demonstrated resilience amid global banking challenges. Despite this, uncertainties persist, urging banks to enhance multi-dimensional resilience for future success.

n paper, 2022 marked a decade-high for banks, boasting impressive performance and a 14-year peak in profitability, yielding around 12 percent return on equity. However, the global banking sector confronts challenges in 2023, driven by significant turmoil in the past six months sparked by interest rate fluctuations. Numerous small to mid-size banks in North America, alongside established institutions in America and Europe, grapple with substantial stress, leading some to declare bankruptcy. Amid a subdued economic growth forecast and persistent geopolitical issues, the growth and profitability of global banking are expected to encounter ongoing difficulties. Indian banks have stood firm amid global macroeconomic and interest rate fluctuations, positioning themselves for robust financial returns. However, it's evident that strong financial performance alone may not ensure superior shareholder returns. Indian bankers have faced challenges in operational, reputational, competition, and technology realms, yielding mixed outcomes. According to our research, corporations must go beyond financial metrics for sustained success. Institutions with a sustainability focus have witnessed a 50 percent growth increase, aligning with rising investor demands and workforce expectations for comprehensive impact assessment. Now, there's a need to evaluate performance holistically, considering operations, customers, employees, and environmental and social aspects. Any lapses in these areas pose significant profit-and-loss and value-creation risks. This report delves into how Indian banks can fortify their defenses and engage with a broader stakeholder network. It outlines crucial actions across five themes to enhance resilience amid uncertain times.

Indian banks: Financially strong, with opportunities to drive holistic impact

Over the last five years, particularly during the recent global banking upheaval, Indian banks have demonstrated resilience and surpassed their global counterparts in terms of growth and profitability. A significant portion of the banking system remains profitable, primarily propelled by robust expansion in retail and micro, small, and medium enterprises (MSME) lending sectors. The consolidation of public sector banks (PSBs) has further resulted in larger and healthier institutions.

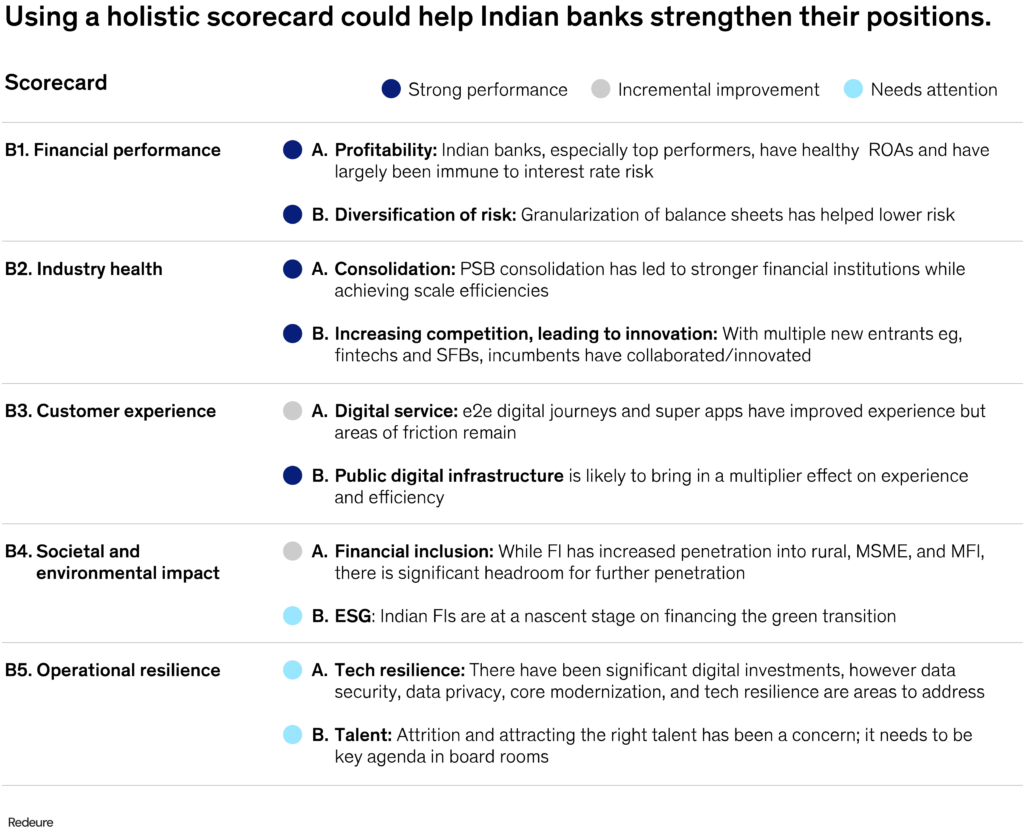

Despite strong financial returns, Indian banks confront numerous challenges within their operating models that could jeopardize their long-term value creation. Recognizing this, it is essential to adopt a more comprehensive perspective on the evolving Indian banking sector. In response, a “holistic impact” scorecard has been devised for Indian banking, outlining five dimensions for improvement to fortify their positions and mitigate business model risks (see Exhibit 1).

Financial Performance: Over the past decade, Indian banks have demonstrated robust credit growth of approximately 10 percent, boasting higher Return on Assets (ROAs) compared to global peers, leading to a valuation premium. Despite maintaining conservative investment portfolios, granular deposit bases, and diversified assets, they have exhibited enhanced resilience to market risks and portfolio concentration. In recent years, there has been a strategic shift towards greater deployment in retail credit and expansion into deeper geographies.

Industry Health: The consolidation of Public Sector Banks (PSBs), reducing from 27 to 12 in the last five to six years, has contributed to the industry’s well-being. This consolidation, coupled with recapitalization, has resulted in stronger and larger banks, fostering increased competition. Simultaneously, specialized banking entities and dynamic fintechs are driving innovation in areas such as payments and microlending, compelling larger incumbent banks to innovate in customer acquisition and service.

Customer Experience: While customer experience and customer-centricity have seen improvement, ongoing investments could further enhance these aspects. Progress has been made in digital journeys and banking super apps, yet creating seamless processes in onboarding, underwriting, and servicing touchpoints remains a goal. India’s evolving public digital infrastructure, particularly with solutions like Account Aggregators (AA) and Open Network Digital Commerce (ONDC) scaling up, is expected to amplify customer services and efficiency.

Societal and Environmental Responsibilities: Indian banks have played a pivotal role in advancing financial inclusion, notably through business-correspondent (BC) coverage and microfinance. However, there is room for growth in incremental market penetration. Environmentally, although most banks have committed to net-zero climate change, comprehensive strategies and Key Performance Indicators (KPIs) are yet to be established. Collaborative efforts between regulators and bankers are necessary to create viable institutions, supportive policies, and frameworks for climate finance. Meeting the transition economy’s financial needs may require significant annual investments over the next decade and beyond.

Operational Resilience: Urgent attention is required in addressing operational resilience for Indian banks, focusing on tech infrastructure, cybersecurity, data management, and talent practices to adapt to a rapidly evolving scale and operating environment. Despite notable investments in digital banking, data management, and privacy, modernizing core tech platforms remains a priority.

Attracting and Retaining Talent: The banking sector in India faces a pressing challenge in talent retention and attraction, with annualized attrition rates increasing up to 30 to 40 percent at frontline levels and high attrition in specialized roles. To address this, banks should scrutinize organizational culture, decision-making processes, and employee value propositions to stay competitive regionally and globally.

Several factors pose challenges to the economic landscape of the banking sector in India.

While banking Return on Assets (ROAs) remains robust, several trends could exert downward pressure on banking profitability in the next three to five years. If not addressed, banks are likely to experience significant margin compression. Key factors contributing to this include:

Net Interest Margins (NIMs): As new-to-credit (NTC) pools undergo credit testing, particularly with increasing penetration, the potential for yield expansion opportunities may be limited. The growth of deposits could face constraints due to a structural shift in household financial product allocation levels in India, leading to a sustained upward bias on interest rates.

Fee Income: The Indian banking sector has witnessed a consistent decline in fee income, influenced by the disintermediation of financial services, heightened customer awareness, and regulatory efforts promoting transparency in charges and schedules. The increasing prevalence of partnerships has further divided fee-income pools among banks, non-banking financial companies (NBFCs), and fintechs.

Operating Expenses: Intensified competition and a shift in talent profile are anticipated to result in higher-per-unit personnel costs. This could be alleviated through a technology-led transformation in sourcing, underwriting, operations, and support functions, potentially leading to increased productivity over time. Consequently, there may be a significant divergence in operating expenses among banks, contingent on their approaches to talent management, digital transformation, and technology capital expenditure (CapEx).

Moving forward: Establishing Robust Leadership

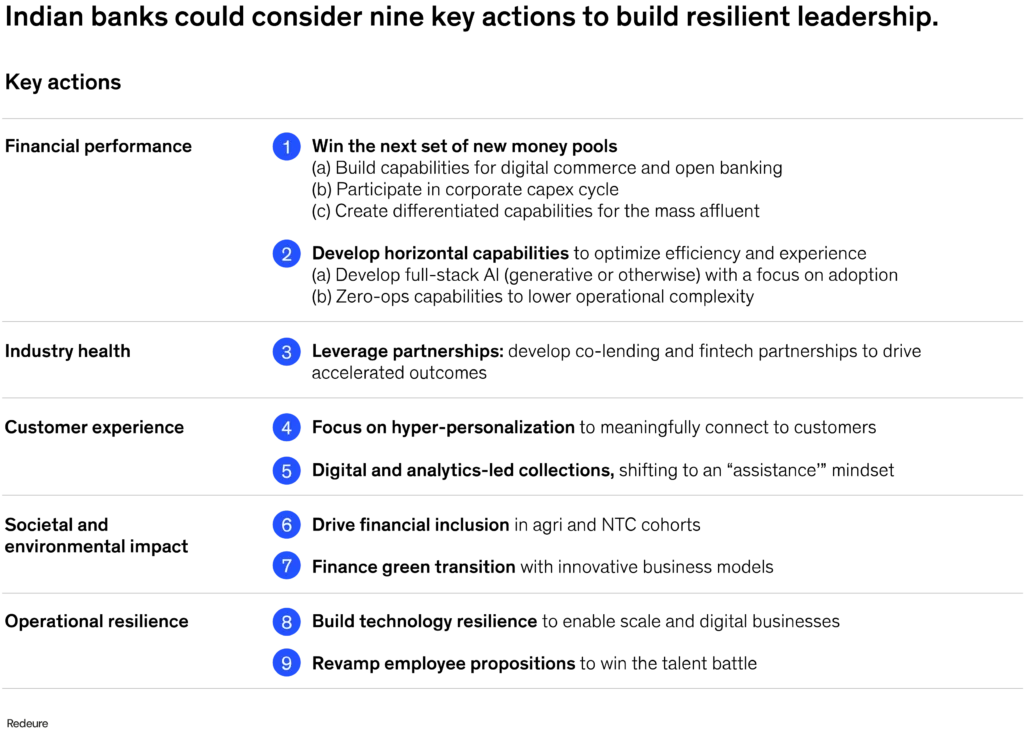

Although Indian banks have excelled in financial metrics, they might need to undertake substantial measures to ensure sustained outperformance. Moreover, continuous enhancement of non-financial metrics is vital for consistent value creation. To accomplish this, nine priority actions can be implemented across five overarching parameters that Indian banks can embrace (refer to Exhibit 2).

Financial Performance

Enhancing financial performance is achievable for banks by discovering new sources of growth and developing capabilities to enhance customer experience and operational efficiency.

Capture the Next Wave of New Revenue Streams

To secure a substantial share of emerging income sources, banks should strategically focus on the following areas:

a. Develop capabilities for digital commerce and open digital infrastructure: Initiating with Account Aggregators (AAs) sets the stage for the future of consumer and merchant finance. When combined with protocols like Open Network Digital Commerce (ONDC), achieving end-to-end digital sourcing in traditionally challenging segments (such as new-to-credit pools and microenterprises) becomes a feasible near-term goal. Banks should adopt a digital-first mindset, forming cross-functional teams for product, risk, and operations, along with partnership management, to establish a modular and scalable integration layer across platforms.

b. Engage in financing an expanding capital expenditure (capex) cycle: Anticipating increased capex spending in both public and private sectors, corporate lending is poised to grow at 8 to 10 percent in the coming years. Concentrated investments are expected in specific sectors, supported by enabling policies and infrastructure. Banks can strategically position themselves by developing strong knowledge and product propositions, reinforcing or building product offerings, and enhancing underwriting capabilities. This requires a thorough review of corporate banking processes using analytical techniques and digital workflow platforms to enhance insights and productivity.

c. Address the underserved mid- and mass-affluent segments in wealth management: These segments are projected to be significant contributors to wealth creation in India over the next decade. Considering their substantial size (around 14 to 15 percent of the population), banks aiming for scale should invest in digital capabilities and self-serve wealth platforms. Collaboration with wealth-tech companies is a viable option for banks to efficiently build these capabilities.

Establish Cross-Cutting Capabilities for Enhanced Efficiency and Experience

Artificial Intelligence (AI), both generative and otherwise, is on the verge of transforming banking. Various use cases are being experimented with and scaled up for production, particularly in reducing human intervention in repeatable, rules-based processes like “know your customer” (KYC), anti-money laundering (AML), routine customer service requests, and certain credit decisioning activities.

a. Implement Full-stack AI Capabilities with a Focus on Adoption: While many banks acknowledge the value of integrating AI and machine learning (ML) into their decision-making, challenges such as a fragmented data landscape, limited data governance practices, talent shortages, and underutilized analytics platforms hinder full AI leverage. Successfully scaling generative AI (gen AI) requires a holistic business system approach, supported by a culture of experimentation. To achieve this, banks should encourage cross-functional collaboration, ensure rapid feedback cycles between business, product, and analytics, and prioritize the creation of explainable models.

b. Integrate Zero-ops Capabilities for Reduced Operational Complexity: Back-end operations involve multiple complex and data-intensive, repeatable, rules-based tasks. While attempts have been made to introduce robotic process automation (RPA), the piecemeal approach has led to partial gains. While near-term optimization is essential, banks should concurrently develop a roadmap for zero-ops. This involves reevaluating end-to-end operations and extending interventions beyond the operations function to include front-end demand management and hygiene practices. A zero-ops transformation could potentially improve efficiency and internal and external net promoter scores (NPS) by 30 to 50 percent across the organization.

Industry Health

Expanding co-lending initiatives and collaborating with fintech partners can enable banks to broaden their reach beyond conventional channels, enhance customer involvement, and lower operational expenses.

Utilize Co-lending and Digital Collaborations for Scalability

The co-lending model in India offers a distinctive framework designed to facilitate lending to the smallest MSMEs and segments with limited expertise. Despite recent traction (approximately INR 25,000 crore or $3 billion), a lack of standardized product norms, policy templates, and API protocols has hindered the expansion of point-to-point integrations. Collaboration between banks and intermediaries could establish industry-wide standards to foster accelerated growth in co-lending. Fintech partnerships, leveraging their digital lending capabilities, understanding of surrogate data, and technologically advanced operating models, represent a significant opportunity. Furthermore, integration with large-scale B2B and B2C consumer platforms provides banks with a substantial opportunity to enhance digital sourcing penetration and reduce operating costs.

Customer Experience

The emergence of fintechs and big tech in retail banking and related sectors has prompted banks to place a growing emphasis on enhancing customer experience to uphold their leadership roles. We identify two prospects for banks: utilizing personalization and employing digital and analytics-driven collections to enhance the overall customer experience.

Drive improved customer experience through personalization

While personalization is a common practice in most banks, the scope and level of maturity can vary significantly. Many Indian banks employ segment- or rule-based engagement strategies, targeting similar customer cohorts with comparable messages. The static nature of defining next-best-action strategies often overlooks past interaction feedback and the latest signals. The maturation of the digital marketing and analytics landscape now allows for tailoring engagement strategies and content at an individual level, potentially resulting in a three to five-times increase in conversion and retention rates. Banks can establish a clear roadmap, encompassing digital capabilities, analytics infrastructure, and organizational structure, to advance to this dynamic hyper-personalization level.

Enhance Customer Experience Through Digital and Analytics-Driven Collections

As customers increasingly embrace digital channels, they anticipate a seamless experience throughout their loan journey. To retain customer loyalty, banks should transition from a collections-centric approach to a customer-service mindset in their loan-servicing activities. This transformation requires a cultural shift and the development of essential technology infrastructure and analytics models to customize strategies based on customer behaviors. Our analysis indicates that this shift could yield substantial benefits, including a potential reduction of collections costs by up to 15 percent and a fivefold increase in engagement.

Societal and Environmental Impact

Indian banks have made substantial progress in advancing financial inclusion, achieving approximately 78 percent penetration of bank accounts. However, there is untapped potential for further financial inclusion in formal credit access, particularly in the new-to-credit (NTC), rural, and agriculture segments. On the environmental front, Indian financial institutions still have considerable room for growth in facilitating green transition and decarbonization through financing opportunities.

Foster Financial Inclusion with Emphasis on Rural and Agricultural Markets

The demand for rural credit has surged by more than 10 percent in recent years, indicating significant untapped potential in these segments. While public sector entities and inclusion players like microfinance institutions (MFIs) and rural non-banking financial companies (NBFCs) have traditionally driven this growth, there’s a clear opportunity for banks to achieve profitable and substantial expansion. Despite the apparent fragmentation of the rural segment, selecting the right markets based on factors like crop types, specialty produce, allied activities, and investment credit could enable banks to penetrate profitable clusters deeply. This approach involves creating a curated go-to-market strategy by leveraging value chains, business correspondents (BCs), self-help groups (SHGs), and other intermediaries. Additionally, advancements in land-record digitization, geospatial technologies for land zoning, and the widespread use of credit bureaus by MFIs offer banks the chance to disrupt the market by providing streamlined lending to specific segments. This requires the development of appropriate enablers and collaboration across various bank teams, such as the agri-lending stack and micro-market-based go-to-market strategies.

Fund India’s Green Transition and Decarbonization

There is a substantial gap of approximately 75 percent between India’s climate finance needs and its current supply. While discussions on the Reserve Bank of India’s draft regulations on climate finance are ongoing, banks have the opportunity to take the lead in crucial areas of the climate finance agenda. Similar to banks in other countries, Indian banks can initiate viable partnerships and go-to-market models for emerging industries (such as electric-vehicle batteries and charging points), enhance their green finance product offerings, and establish internal pathways for reducing financed emissions. Banks should also contemplate the formation of dedicated sustainability organizations in anticipation of the broader development of climate finance capabilities.

Operational Resilience

To thrive in a swiftly evolving environment and enhance resilience, banks may consider increased investments in scalable and secure technology. Additionally, there’s a need for a fundamental shift in how they discover, attract, and nurture talent.

Enhance Operational Risk Management Through Technology Resilience

Technology resilience encompasses a multifaceted approach that demands intentional design and ongoing active management. Indian banks can concentrate on three key areas:

a. Modernizing core systems and API management with a focus on flexibility and scalability, along with clear governance and ownership assigned across infrastructure, application, and event management.

b. Developing a robust cloud strategy capable of efficient load management and secure data access for decision-makers.

c. Strengthening cybersecurity, information security, and adherence to data privacy norms.

Data governance plays a crucial role, necessitating clear ownership and an ongoing maintenance structure to maximize value extraction and mitigate risks associated with digital and analytics.

Overhaul Employee Value Propositions

The composition of banking talent has evolved, requiring more individuals with skills in product management, technology, data analytics, and design. However, attrition rates in these and frontline functions have reached unprecedented levels, surpassing 40 percent on an annualized basis in some cases. Compensation is just one aspect of addressing the talent challenge. Banks should explore empowering employees, fostering collaboration, implementing structured mentoring programs, enhancing the work environment, tools, and recognition strategies. A comprehensive revamp of the employee value proposition, both internally and externally, is essential. This involves assessing satisfaction and attrition levels across critical roles and ensuring that talent strategies are deliberated at the CXO and board levels.

While Indian banks have demonstrated resilience amid recent banking sector volatility, relying solely on financial benchmarks is no longer sufficient. A holistic perspective, encompassing both financial and non-financial metrics, is crucial. Resilient leaders should take decisive action on the key steps outlined above to ensure consistent value creation, risk mitigation, and customer-centricity in an increasingly competitive industry.

You May Also Like

Why the path of global wealth and growth matters for strategy

Discover the crucial link between global wealth and growth in strategic decision-making. Uncover ins

Hybrid Financing- Part 1

This article serves as an introduction to the enhancement of program investments, encompassing intel

Securing Capital for Real Estate

There are three primary types of real estate: Residential, Commercial, and Industrial. Each sector h