Why the path of global wealth and growth matters for strategy

Four possible scenarios exist for the potential developments in global economics over the next decade. Here’s a guide for companies on how to navigate and plan accordingly.

ecent worldwide turbulence prompts the question: Is the world undergoing a shift toward a new long-term economic paradigm? New research from the Redeure Research Institute (RRI) and a recent survey of Redeure executives suggest this possibility, though the precise nature of this future remains uncertain. It's crucial for business leaders to be cognizant of potential scenarios so that they can adapt and strategize accordingly.

RRI assesses economic health and wealth using a unique perspective called the global balance sheet, a concept borrowed from the corporate realm to encompass all of the world's assets and liabilities, including net worth. Our analysis through this lens indicates that the developments of the past two decades have contributed to the current economic, financial, and market uncertainties.

Over the last two decades, the global balance sheet experienced a much more rapid growth compared to the real economy, as measured by GDP. This growth was fueled by the maintenance of low-interest rates to stimulate economies, leading to an increase in asset prices and debt. Between 2000 and 2021, $160 trillion was added to paper wealth, driven by surging asset prices due to low interest rates. For every $1 invested, $1.90 of debt was generated during this period. Concurrently, productivity growth in G-7 economies slowed significantly. From 1980 to 2000, productivity grew at a rate of 1.8 percent per year, but from 2000 to 2018, it decelerated to only 0.8 percent annually. This phenomenon resulted in an environment of classic secular stagnation, where an excess of savings pursued too few productive investments, contributing to wealth accumulation but hindering growth and exacerbating inequality.

Most executives have navigated their professional lives within this stable yet challenging environment. However, the future presents the potential for significant change, with an unusually broad range of plausible medium-term scenarios. As a result, the intuition that has guided many business leaders in their careers may no longer be as reliable. Given this uncertainty, companies and their leaders are advised to prepare for various possibilities.

This article delves into the dynamics behind the expansion of the global balance sheet. It then outlines four scenarios for what might unfold next, providing a broad overview of the potential impact each scenario could have on the global economy. Additionally, the article identifies which scenario is considered most likely by approximately 1,000 surveyed executives and asset managers. Finally, it suggests steps that business leaders can contemplate to prepare for the prevailing scenario.

Successful approaches employed over the years of global balance sheet growth

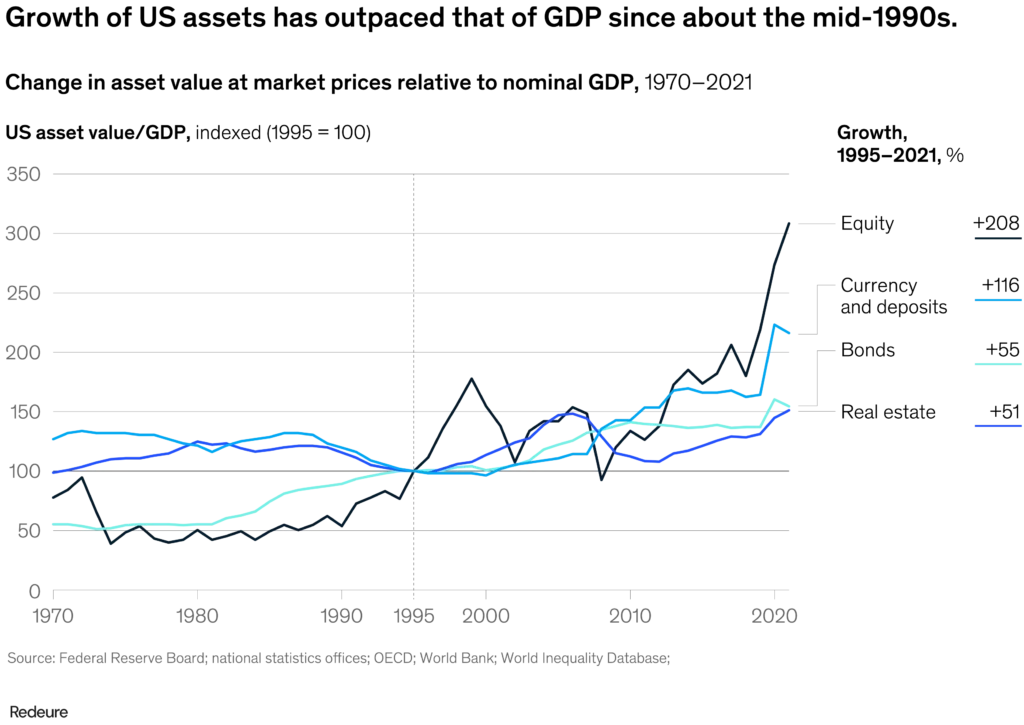

Leveraged investors have experienced significant success since the beginning of the millennium. For instance, in the United States, the market value of real estate increased 1.5 times faster than GDP from 1995 to 2021 (see Exhibit 1), and in the United Kingdom, it grew 1.8 times faster. The value of equities in the United States expanded at a rate three times higher than that of GDP.

In this environment, several strategies gained popularity. Given the accessibility of cheap credit, leveraged approaches and financial tactics thrived. This encompassed leveraged buyouts, strategies involving leveraged assets, the escalation of corporate debt, and extensive share buybacks. With exceptionally low discount rates and substantial venture capital investments, dynamic growth strategies, particularly in technology but not limited to it, often outperformed those emphasizing early profitability and steady returns.

The affordability of capital prompted a focus on long-term enterprise success, envisioning achievements well into the future, such as 2050, rather than solely aiming for short-term potential by the early 2020s. New productive investments faced challenges in competing with the allure of opportunities arising from asset price appreciation and transactions. In extreme cases, businesses shut down, and corporate locations were repurposed for residential real estate.

In a climate of modest yet sustained economic growth, efficiency took precedence over resilience. With a surplus of labor, recruitment and retention efforts concentrated on highly skilled individuals. Wage—and, even more significantly, wealth—inequality increased, leading certain sectors to target high-net-worth individuals and premium or luxury market segments.

Will a new balance of wealth and growth emerge?

What lies ahead? Following a peak during the pandemic, marked by global wealth growing at a faster pace relative to GDP than in any other two-year span in the past fifty years, it seems a departure from the two-decade trend may be on the horizon. However, there is discord among economists and business leaders regarding the nature of this change. Will inflation persist at elevated levels for an extended period? Will there be a correction in asset prices accompanied by deleveraging? Alternatively, is the global economy poised for a phase of heightened productivity and growth?

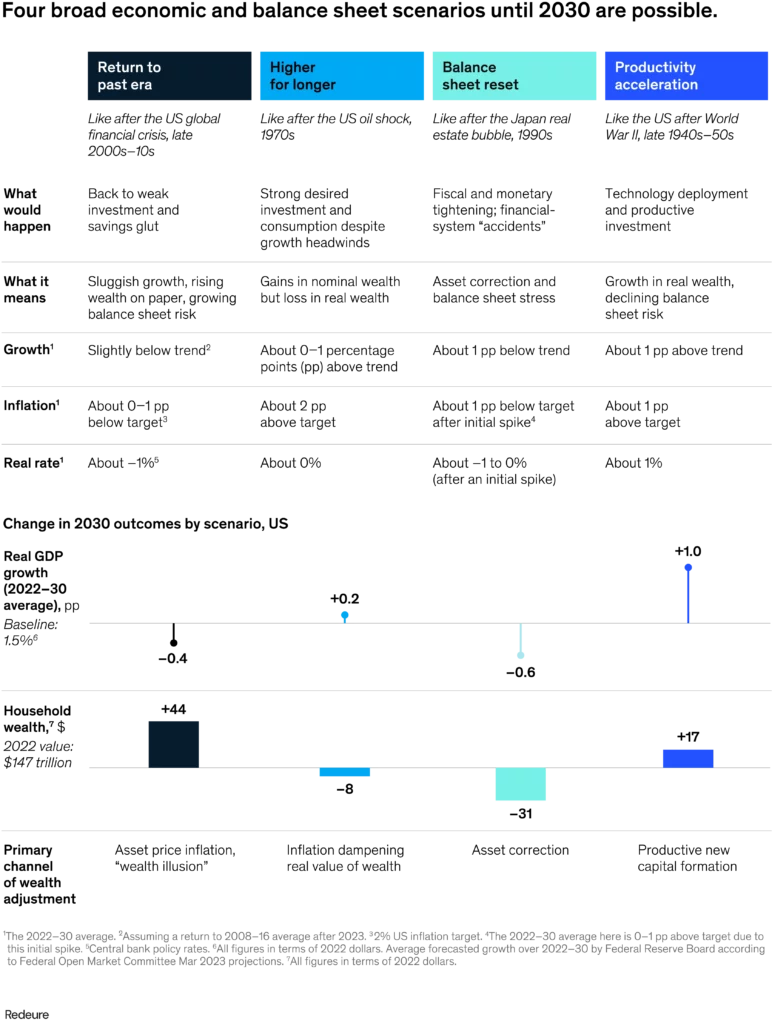

RRI has developed scenarios based on each of the above three possibilities—and a fourth scenario in which the past era of balance sheet expansion resumes (Exhibit 2). Each of these scenarios is plausible. While structural forces, which may push inflation higher, are in play, central banks’ commitments to curtail inflation could cause corrections and deleveraging. Higher investment, along with the continued spread of digital and AI technologies, might boost productivity and help the world grow out of an outsize balance sheet (see sidebar, “The four scenarios”).

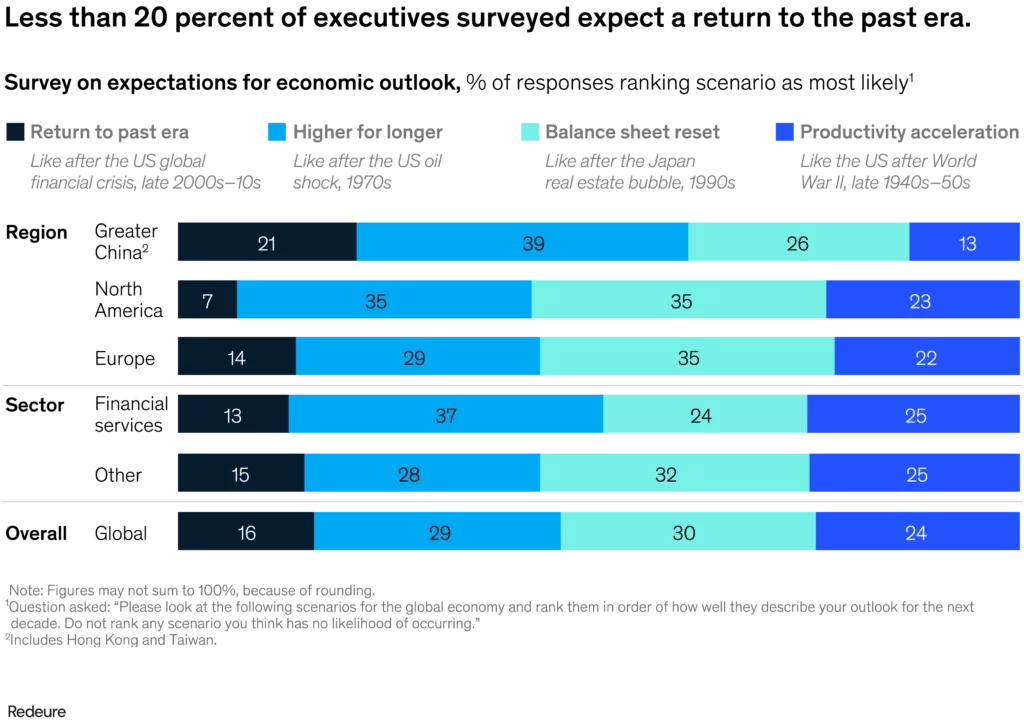

When surveyed by RRI, approximately 1,000 executives expressed their expectations for the most likely scenario, with 84 percent anticipating a departure from the patterns observed in the past era. Among the remaining options, their preferences were roughly evenly distributed (see Exhibit 3). Responses varied based on both sector and geography. Financial-services executives, including about 50 C-suite executives of major asset managers surveyed separately, leaned towards the likelihood of a "higher for longer" scenario, anticipating that inflation and interest rates would remain elevated for a significant portion of the upcoming decade. Similarly, respondents in Greater China also favored the "higher for longer" scenario, while a plurality of those in Europe leaned towards a "balance sheet reset." North American respondents were divided between these two scenarios.

Why the next era may be different

Few respondents anticipate a return to the past, reflecting the likelihood of numerous ongoing long-term structural shifts. The outcomes of these shifts remain uncertain.

The persistent growth of the global balance sheet in the last two decades has primarily resulted from limited investments in productive endeavors and an abundance of savings, leading to lower interest rates, increased debt, and rising asset prices.

This pattern could shift if there is an upswing in productive investments. The transition to a net-zero economy will necessitate substantial expenditures. Recent disruptions in supply chains, stemming from both the COVID-19 pandemic and Russia’s invasion of Ukraine, have underscored the importance of supply chain resilience, prompting some reconfigurations that require investment. Increased defense spending might also present an area for investment, and in the United States, the Infrastructure Investment and Jobs Act could spur significant infrastructure investment.

The global savings surplus might diminish. One contributing factor to increased savings was growing inequality, coupled with a decline in the labor share of income, reducing consumption by disproportionately directing a significant portion of value creation to the wealthy, who tend to save more. With tight labor markets, the balance could shift towards higher consumption. Aging populations have been saving without significant spending in retirement, but this trend may change. A rising dependency ratio means that the proportion of people utilizing their retirement savings increases, while the share of those saving during their working years declines (though this is a matter of some debate among economists).

Can Businesses equip themselves?

The macroeconomic trends observed over the last two decades may have concluded, yet the spectrum of potential economic scenarios between now and 2030 is extensive. Hence, it is prudent for leaders in all types of businesses to establish a foundation for a potentially divergent future and be prepared to navigate operations amidst uncertainty.

Track the right markers

As an initial step, businesses should consider the identification of a comprehensive set of indicators to help discern the likelihood of different scenarios. While many executives often focus on recent inflation figures, it is crucial to pay attention to more fundamental markers that differentiate between scenarios. Some essential examples include:

Central bank trade-offs: Despite having a clear price stability mandate, many independent central banks also grapple with a financial stability mandate, creating potential tension. What discussions are ongoing regarding these trade-offs?

Fiscal policy stances: The potential impact of fiscal tightening on inflationary pressure is significant, especially considering concerns about financial stability with interest rate increases. Where and to what extent is tightening likely to occur?

Business investment: Is there a notable increase in commitments and actual investments, such as a rise of two percentage points of GDP or more? If so, the likelihood of a shift towards accelerated productivity increases, making a return to balance sheet expansion less probable.

Other relevant markers include dynamics related to wages and bargaining power, profits, and inequality. Additionally, factors like shifts in effective retirement ages versus life expectancy, as well as geopolitical considerations and global flows, should be taken into account. Given the potential occurrence of any of the four scenarios, it is advisable for businesses to monitor these trend indicators and seek diverse economic perspectives rather than relying solely on “consensus” forecasts.

Pressure test the business for what might come

Businesses, including financial institutions, have the opportunity to extend their risk management practices by moving beyond the conventional sensitivities typically tested. Utilizing these four scenarios can serve as a robust method to pressure-test business models. Companies may also contemplate reinforcing equity buffers, fortifying balance sheets, and/or implementing strategies to hedge against macroeconomic risks, among other strategic considerations.

Businesses, including financial institutions, have the option to expand their risk management practices by going beyond the usual sensitivities they test. Using these four scenarios can serve as a method to thoroughly evaluate and assess the resilience of business models under different potential future conditions.

Understand how strategy could transform depending on scenario

Firms have the option to take different approaches based on their preferences and risk tolerance. Some may choose to bet on a single scenario, while others might focus on building flexibility and robustness to navigate multiple possibilities. A return to the past era essentially represents business as usual, carrying its inherent risks. To prepare for significant changes proposed by the three other scenarios, specific actions may be necessary:

Higher for Longer:

- Develop capabilities in pricing, procurement, and productivity to address higher input prices and wages.

- Adjust the business portfolio to align with growth opportunities and shield against rising costs.

- Emphasize scale to protect margins in an environment of increasing costs and interest rates.

- Lock in favorable conditions, such as long-dated maturities in financing and long-term contracts for labor and suppliers.

- Consider focusing on affordable market segments as inequality decreases.

Balance Sheet Reset:

- Establish a flexible cost base to adapt to a potential economic slowdown.

- Reduce debt exposure and limit vulnerability to market fluctuations in equity and real estate.

- Identify debtors who may face challenges in repaying in a scenario of balance sheet reset.

- Build “fortress balance sheets” to weather economic challenges and seize opportunistic responses during distressed M&A opportunities.

- Consider holding cash as a protective measure against asset corrections and defaults.

Productivity Acceleration:

- Invest in technology, new capacity, and automation to capture market growth ahead of competitors.

- Focus on driving productivity acceleration, such as through providing innovative technologies.

- Secure access to human capital and materials in anticipation of a competitive market.

- Lock in long-term financing early as interest rates rise.

- Explore opportunities in growth equities, recognizing potential headwinds in real estate investments.

- Engage in capital projects and business finance for financial institutions, considering the potential for substantial opportunities.

- Each scenario requires tailored strategies and actions, and businesses may choose to prioritize or combine these approaches based on their assessment of future economic conditions.

Companies are not merely observers; instead, they actively contribute as participants whose combined actions influence the unfolding of specific scenarios.

Amidst uncertainty and economic challenges, companies may instinctively adopt a purely defensive stance, aiming to minimize negative impacts and enhance resilience. However, an exclusively defensive approach can inadvertently contribute to a self-fulfilling cycle of pessimism.

Companies that solely plan for economic slowdowns or recessions may hesitate to invest, awaiting more favorable conditions. Anticipating persistent inflation might lead to proactive price increases, potentially exacerbating the feared inflation. Real estate investors expecting declining prices might delay initiating new projects, and banks focused on bolstering their balance sheets might tighten lending standards, reducing the number of loans offered.

To propel the economy toward accelerated productivity growth, it is crucial to adopt an offensive strategy as well. Businesses require strategic boldness to invest significantly in emerging opportunities and commit to the necessary human capital. Promising opportunities lie within well-known megatrends such as the energy transition, aging and healthcare, resilient supply chains, increased defense investments, and advancements in technologies like AI. How firms manage inflation is also pivotal: enhancing labor, materials, and energy productivity allows for higher wages and prices without passing elevated costs onto consumers.

While pessimism prevails, there is potential for a scenario of productivity acceleration. Approximately one-quarter of executives surveyed by MGI view it as the most likely scenario among the four, believing it is achievable with the right actions.

Adapting to a new era requires challenging and prolonged adjustments, involving a reassessment of assumptions and modifications to planning, strategy, and business models. Few anticipate a return to business as usual, and this sense of realism serves as a practical starting point.

You May Also Like

Is the Prediction of China’s Global Dominance Fading?

In recent years, pundits and analysts alike have speculated on the inevitable rise of China as a glo

Eurozone Inflation Declining; UK Continues to Struggle

While the United Kingdom grapples with controlling inflation, the Eurozone experienced a surprising

Is Germany Headed Towards a Recession?

The data from the ifo Institute and other indicators suggest that Germany, Europe’s largest ec