Investors are interested in companies addressing the significance of sustainability.

Investors are urging companies to refine their equity narrative and articulate the value of their sustainability efforts. Company leaders can take the following steps to meet this expectation.

hile over 95 percent of S&P 500 companies publish sustainability reports, very few seamlessly incorporate environmental, social, and governance (ESG) considerations into their equity narratives. The absence of a distinct connection between sustainability and corporate strategy can pose challenges for investors in comprehending the impact of a company's initiatives on financial performance and, notably, intrinsic value.

A recent survey of chief investment officers indicates that significant investors acknowledge the importance of Environmental, Social, and Governance (ESG) considerations but express a need for clearer understanding of the ESG value proposition (refer to the sidebar, “How intrinsic investors look at ESG initiatives”). Simply presenting sustainability aspirations or metrics on paper, devoid of context, falls short in establishing a direct connection between initiatives and cash flow. This lack of clarity offers companies an opportunity to articulate the ESG-to-value case more explicitly.

The Investor’s view

Investors with a long-term perspective, referred to as “intrinsic investors,” significantly influence stock performance over an extended period. These investors acknowledge the impact of Environmental, Social, and Governance (ESG) factors on value, yet they consistently seek a deeper understanding. Intrinsic investors actively seek detailed information about how specific ESG initiatives contribute to growth, identify the most relevant risks for a particular company and its industry, and assess the extent to which distinct ESG actions can effectively mitigate those risks.

The Pursuit for clarity

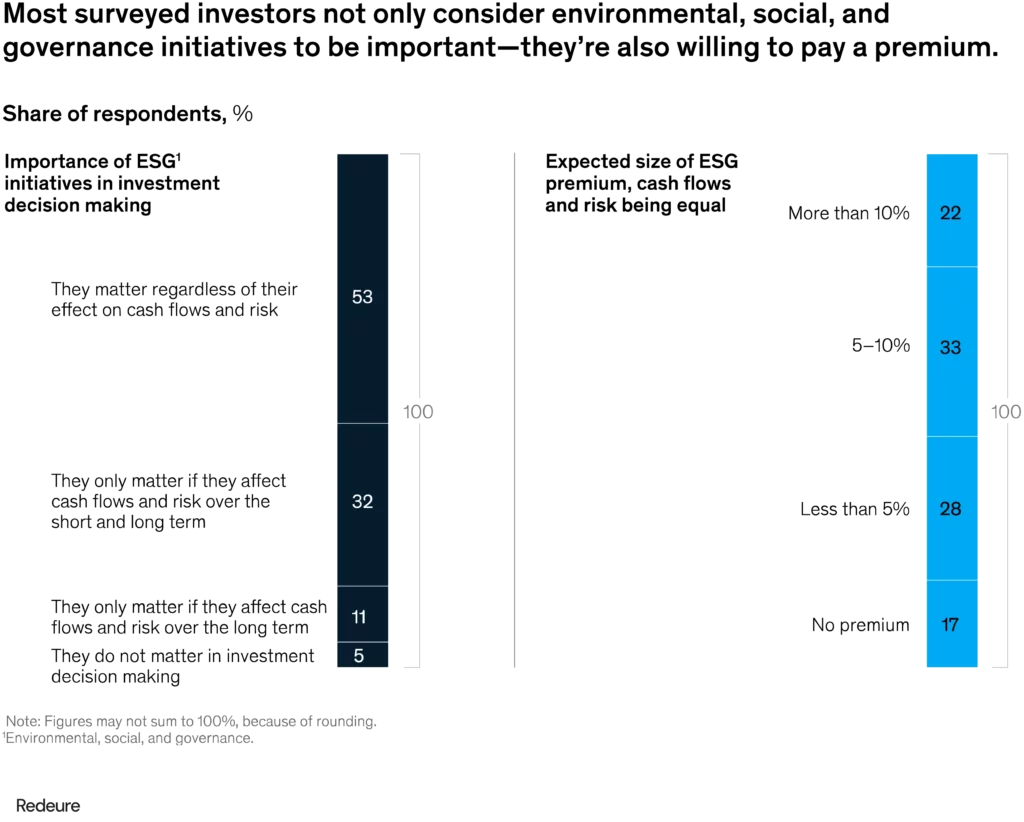

Approximately 85 percent of the chief investment officers surveyed emphasize the significance of Environmental, Social, and Governance (ESG) factors in their investment decisions. Sixty percent of respondents conduct a comprehensive ESG review of their entire portfolio, while around 80 percent evaluate individual company positions, considering how ESG factors impact projected cash flows. Notably, a substantial majority of these investors are willing to pay a premium for companies that demonstrate a transparent connection between their ESG initiatives and financial performance (refer to the exhibit).

However, investors surveyed express dissatisfaction with the current state of companies’ Environmental, Social, and Governance (ESG) communications, highlighting several significant shortcomings. Respondents seek more transparent methods to gauge long-term value, greater regulatory certainty, and practical frameworks related to ESG.

Investors are also keen on having clearer ESG standards. They recognize that current ESG scores, unlike financial ratings, lack full correlation across providers. Financial ratings typically exhibit around a 99 percent correlation among providers, whereas ESG ratings may have correlations of less than 60 percent due to variations in elements and weighting assigned to different ESG metrics by each agency.

A substantial majority of chief investment officers are willing to pay a premium for companies that can establish a clear connection between their Environmental, Social, and Governance (ESG) initiatives and financial performance.

The importance of sectoral differences

Achieving greater Environmental, Social, and Governance (ESG) clarity, as indicated by investors, involves recognizing industry-specific differences. For instance, in the energy sector, investors prioritize capital productivity and cost optimization, a trend similarly observed in the industrials, materials, and consumer sectors. While investors generally consider the elements of Environmental, Social, and Governance factors to be equally important across all industries, the importance assigned to each element varies within individual industries. Investors perceive that excellence in different pillars is necessary based on a company’s sector. In the industrials and energy sectors, surveyed investors emphasize ESG initiatives in the environmental dimension. For companies in the technology, pharmaceuticals, and travel, logistics, and infrastructure sectors, social initiatives are considered the most crucial. In contrast, investors rank governance concerns the highest for companies in the financial and insurance industries.

Notably, in some industries, the absence of a clearly defined ESG strategy prompts investors to contemplate reducing their exposure or divesting entirely. This tendency is particularly evident in investments related to the energy, materials, and travel, infrastructure, and logistics sectors. However, in most cases, ESG considerations are part of a broader array of detailed investment factors that investors take into account.

The promising opportunity lies in crafting a more value-focused Environmental, Social, and Governance (ESG) narrative.

There is a compelling opportunity for companies to deliver a more detailed and nuanced Environmental, Social, and Governance (ESG)-to-value case in response to increased investor demand. Essentially, companies should clarify the relevance of ESG for their business—how ESG initiatives contribute to value creation, and what key levers and value drivers are at play. Drawing a parallel with how CEOs and CFOs provide context for quarterly and annual earnings in their presentations, publicly filed reports are a starting point but not the entirety of investor communications. Managers should not rely solely on formulaic ESG reporting, as just as reports filed under generally accepted accounting principles do not fully describe strategy, carbon disclosures and other ESG metrics lack sufficient descriptions of strategic impact without additional context about the company’s unique business model.

Understand your audience

“Understand your audience,” a fundamental principle of communication in any context, is crucial for corporate communications on Environmental, Social, and Governance (ESG). Often, the media refers to “investors” as a homogeneous group with similar interests, but experienced CFOs recognize that different shareholders have varied strategies, and it’s impossible for a widely held company to satisfy every investor. A strategic segmentation exercise helps senior leaders understand their target audience and tailor investor communications accordingly.

Segmenting investors into categories such as intrinsic investors, traders, indexers, closet indexers, and retail investors has been suggested as a practical approach. Research indicates that intrinsic investors, who drive long-term share prices, should be the primary audience for communications outlining the company’s long-term value creation.

ESG can be a compelling component of this intrinsic value story. Some investors use rankings or rules to screen out certain companies based on ESG criteria, such as avoiding oil and gas companies. However, intrinsic investors who consider ESG important fall into two basic segments:

- Long-term investors: They view ESG as a crucial consideration, using it to enhance their decision-making. For instance, rather than outright avoiding oil and gas companies, they may differentiate based on carbon emission reduction rates.

- Economic impact-focused investors: They strictly assess the economic consequences of ESG initiatives, particularly on cash flows and value creation. This group might avoid companies with a higher risk of stranded assets or those vulnerable to climate-related risks.

Crafting an ESG equity story that directly links to sustained financial performance and long-term value creation should satisfy both intrinsic investor segments. Companies should recognize that their target audience is sophisticated, long-term oriented, and intensely focused on sustainable competitive advantage when conveying ESG initiatives in their equity story.

When incorporating Environmental, Social, and Governance (ESG) initiatives into its equity narrative, a company should be mindful that its intended investor audience is sophisticated, has a long-term orientation, and is unwaveringly focused on sustainable competitive advantage.

Addressing the ‘how’ of sustainability communications involves detailing the specific strategies and methods to effectively convey information about sustainability initiatives.

Incorporating Environmental, Social, and Governance (ESG) into equity stories and strategic communications involves more than just recognizing market trends. While some aspects of the process are relatively straightforward, there are challenges that companies often face in effectively communicating their ESG initiatives. A compelling ESG equity story should address the following key issues:

- Understanding Market Changes: Clearly articulate the changes happening in the market, such as shifts in consumer preferences or advancements in technology. Provide a detailed management perspective on how quickly these changes are occurring and their potential impact on the business.

- Defining the Company’s Strategy: Clearly outline the company’s strategy in response to ESG considerations. This includes decisions on whether to make specific bets or keep options open, as well as the company’s view on addressing uncertainties and leveraging opportunities.

- Linking ESG Strategy to Value Creation: Establish a direct link between the company’s ESG strategy and its value creation strategy. Explain in a granular way why specific ESG initiatives were chosen and how they will contribute to enhancing or sustaining cash flows, return on capital, margins, top-line growth, and talent attraction and retention.

- Providing Evidence of Strategy Effectiveness: Offer proof points that demonstrate the effectiveness of the ESG strategy. This could include quantitative and qualitative data on how the company is winning in the ESG space and what specific competitive advantages it holds.

- Highlighting Risks and Opportunities: Clearly communicate the risks and opportunities associated with the company’s ESG strategy. Investors appreciate a probability-weighted assessment of scenarios, both on the upside and downside, allowing for a comprehensive understanding of how the company is managing ESG-related risks and leveraging opportunities.

Effectively addressing these elements in an ESG equity story requires clear and decisive communication that goes beyond vague statements. Providing detailed insights into the company’s stance on market changes, strategic choices, value creation, evidence of success, and risk management will contribute to a more compelling narrative.

Investors acknowledge the significance of Environmental, Social, and Governance (ESG) factors in their investment decisions. Consequently, it’s imperative for executives to take a proactive approach and fully integrate ESG into their equity narrative. This entails establishing a clear connection between ESG initiatives and value creation, allowing companies to distinguish themselves from their peers based on the impact of their ESG efforts. This strategic communication can contribute to shaping a compelling equity story that resonates with investors and aligns with evolving market expectations.

You May Also Like

Hybrid Financing- Part 1

This article serves as an introduction to the enhancement of program investments, encompassing intel

Why the path of global wealth and growth matters for strategy

Discover the crucial link between global wealth and growth in strategic decision-making. Uncover ins

Finance in Mining

The International Finance Corporation (IFC) supports global mining operations through diverse financ